What would become of business without a market of fools?

— Chuang Tzu, 4th century BCE.

John Adams (1735 – 1826) [2nd President of the United States]:

The envy and rancor of the multitude against the rich is universal and restrained only by fear or necessity.

A beggar can never comprehend the reason why another should ride in a coach while he has no bread.

(Zoltan Haraszti, John Adams and the Prophets of Progress, Harvard, 1952, p 205)

Alexander Hamilton (1756 – 1804):

Why has government been instituted at all?

Because the passions of men will not conform to the dictates of reason and justice without constraint.

(Federalist No 15 Papers, 17 September 1787)

Peter Singer (1974):

For all the claims that “big government” can never match the private sector, [the Defence Advanced Research Projects Agency] is the ultimate rebuttal.

The Internet … e-mail, cell phones, computer graphics, weather satellites, fuel cells, lasers, night vision, and the Saturn V rockets [that first took man to the moon] all originated at DARPA. …

DARPA works by investing money in research ideas years before any other agency, university, or venture capitalists on Wall Street think they are fruitful enough to fund.

DARPA doesn’t focus on running its own secret labs, but instead spends 90% of its (official) budget of $3.1 billion on university and industry researchers …

(Wired for War, Penguin, 2009, p 140)

Mayer Rothschild (1744 – 1812):

If you can't make yourself loved, make yourself feared.

(p 89)

Niall Ferguson (1964):

The first era of financial globalization took at least a generation to achieve.

But it was blown apart in a matter of days.

And it would take more than two generations to repair the damage done by the guns of August 1914.

(The Ascent of Money, Penguin, 2008, p 304)

Andrew Carnegie (1835 – 1919):

[are] the highest results of human experience [—] the best and most valuable of all that humanity has yet accomplished.

- Individualism,

- Private Property,

- the Law of Accumulation of Wealth, and

- the Law of Competition

Arthur Pigou (1877 – 1959):

[All] the best business men want to get money, but many of them do not care about it much for its own sake; they want it chiefly as the most convincing proof to themselves and others that they have succeeded.

(Memorials of Alfred Marshall, 1956, p 282)

Simone Campbell (1945) [Catholic Nun]:

[We were] doing business roundtables [with] some entrepreneur, CEO types. …

A report had just come out that that the average CEO … got $10 million in salary a year, and [that] they were going for $11 million.

I got to ask them:Is it that you're not getting by on $10 million that you need $11 million?And this one guy said: …

I don't get it.Oh, no Sister Simone. …(Krista Tippett, Becoming Wise, Corsair, 2016, p 129)

It's not about the money. …

It's that we want to win.

And money just happens to be the current measure of winning.

PBS Frontline:

There was a phrase — "ripping someone's face off" — that was used on the trading floor to describe when you sold something to a client who didn't understand it and you were able to extract a massive fee because they didn't understand it.

[This was seen as] a good thing because [you were] making more money for the bank.

[That] sort of spirit, of [acting against the best interests of] your client … took on significant life on Wall Street.

(Money, Power and Wall Street, 2012)

Kid Power Conference, Disney World:

Kids love advertising: it's a gift — it's something they want.

There's something to said … about getting there first, and about branding children and owning them in that way. …

In boy's advertising, it is an aggressive pattern [—] antisocial behavior in pursuit of a product is a good thing.

Tim Hammonds [President & CEO, Food Marketing Institute]:

The interchange fee a supermarket pays when a customer pays with plastic is more than the money that flows to the retailer’s bottom line; it’s often double. …

The service provider using a computerized payment network is getting more dollars from the transaction than the net profit for the merchant who provides(FMI Midwinter Executive Conference, 14 January 2006)

- the labor,

- the land,

- the fixtures,

- the light and the heat, and

- the store that stocks the products.

Eryk Bagshaw:

Former AMP chief executive Craig Meller has resigned as a financial services adviser to the Turnbull government. …

Mr Meller stepped down in the wake of revelations at the banking royal commission that AMP had spent a decade deliberately and repeatedly lying to the federal government's regulator over charging customers fees for no service. …

Ms O'Dwyer convened the [Financial Sector Advisory Council] in 2016 to provide advice to Mr Morrison "on potential areas for regulatory reform" …

(Ex-AMP CEO Craig Meller resigns as a Turnbull government adviser, Sydney Morning Herald, 30 April 2018)

Alexis de Tocqueville (1805 – 59):

The people may always be mentally divided into three distinct classes.

(Democracy in America, 1835, Bantam, 2011, p 246)

- The first of these classes consists of the wealthy;

- the second, of those who are in easy circumstances; and

- the third is composed of those who have little or no property, and who subsist more especially by the work which they perform for the two superior orders.

Search This Blog

July 23, 2016

Ministry of Plenty

Live Long and Prosper

July 13, 2016

Tom Switzer

Blue Army: Persons of Interest

[In the 2 years to 2014,] the income share held by the top 1% of households rose [by 12.5%:] from 4.8% [to] 5.4% …

Australians aged 25-34 have had declining incomes since 2009-10. …

[In 2015-16, children] under the age of 15 [had] the highest levels of both:

[Relative] income poverty [has not declined] despite 27 years of uninterrupted growth …

About half of Australians experienced income poverty at some point between 2001 and 2016. …

About [700,000 Australians] have been in income poverty continuously for at least the last 4 years. …

Among 28 OECD countries [Australia ranks:]

The top half of the wealth distribution experienced particularly strong growth …

[The] wealth of the top decile increased by about $620,000 to reach $2.2 million, which is … about 7 times as much as the median person.

[By contrast, the] average wealth of the bottom decile actually fell … from about $10,000 to $8,000. …

Wealth inequality [in Australia] increased over the [12 years to 2015‑16] by 7%. …

The Gini coefficient for wealth (at about 0.6) is close to double the Gini coefficient for income (at about 0.3) …

[A] person at the 90th percentile of the wealth distribution has almost 40 times as much wealth as [a] person at the 10th percentile; for income, they have 4 times as much. …

[There] is less wealth mobility than income mobility, and more ‘stickiness’ at the top and bottom of the wealth distribution. …

If a father’s lifetime earnings are 10% above average for his generation, we would expect his son’s lifetime earnings to be 2–4% above average for his generation.

[Intergenerational earnings elasticity: 0.22 to 0.41]

(M Corak, Income inequality, equality of opportunity, and intergenerational mobility,

Journal of Economic Perspectives, 27:3, pp 79–102, 2013)

Real Inequality

Tom Switzer (1971) [Director, Centre for Independent Studies]:

[Australia] is not like the US where we have seen real income inequality …

[According to the Productivity Commission:]Sustained growth has delivered significantly increased living standards for the average Australian in every income group …(Tim Soutphommasane on the 'political narcissism of minor differences', ABC Between The Lines, 9 May 2019)

[Economic] mobility is high [and] movements in inequality indexes are slight rather than serious.

Robert Carling:

[Redistributive tax policies] have strong disincentive effects …

Economic inequality is not intrinsically bad, and equality does not equate to fairness.

(Whatever happened to incentive?, Centre for Independent Studies, 28 July 2017)

Daniel Wild & Andrew Bushnell:

The best available evidence demonstrates that income inequality is low and declining in Australia.

(Understanding Inequality in Australia, Institute of Public Affairs, November 2017)

Henry Ergas:

Most measures suggest income inequality [in Australia] has now stabilised or diminished …

(Shorten’s fix for imaginary inequality issue is to tax the rich, The Australian, 29 July 2017)

peaceandlonglife:

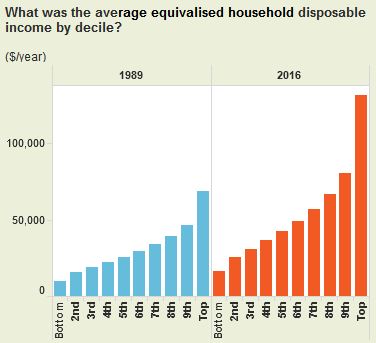

Average equivalised household disposable income in Australia has grown by 2.1% per year (from $30,942 to $53,711) for the last 27 years (1989-16).

This includes a 4 year period of falling incomes (2012-15) following the mining boom.

peaceandlonglife:

Over for the last 27 years, in absolute terms, the incomes of the top 10% have been growing, on average, 7 times faster than those of the bottom 10%.

In percentage terms, the income of the top 10% (2.4%) has been growing 29% faster than the bottom 90% (1.9%).

peaceandlonglife:

In Australia in 1989, the income ratio of the top 10% ($68,495) to the bottom 10% ($9,562) was 7.2 to 1.

By 2016 the income ratio of the top 10% ($131,560) to the bottom 10% ($16,495) had increased to 8.0 to 1.

Ratio of average income of the richest 20% to the poorest 20%.

(Richard Wilkinson & Kate Pickett, The Spirit Level, 2009)

Productivity Commission

[In the 2 years to 2014,] the income share held by the top 1% of households rose [by 12.5%:] from 4.8% [to] 5.4% …

Australians aged 25-34 have had declining incomes since 2009-10. …

[In 2015-16, children] under the age of 15 [had] the highest levels of both:

- income poverty (11.5%, or about 530 000 children), and

- consumption poverty (12.9%, or a little under 600 000) …

[Relative] income poverty [has not declined] despite 27 years of uninterrupted growth …

About half of Australians experienced income poverty at some point between 2001 and 2016. …

About [700,000 Australians] have been in income poverty continuously for at least the last 4 years. …

Among 28 OECD countries [Australia ranks:]

- 3rd in median household wealth, [but]

- [8th in equality of] wealth distribution …

The top half of the wealth distribution experienced particularly strong growth …

[The] wealth of the top decile increased by about $620,000 to reach $2.2 million, which is … about 7 times as much as the median person.

[By contrast, the] average wealth of the bottom decile actually fell … from about $10,000 to $8,000. …

Wealth inequality [in Australia] increased over the [12 years to 2015‑16] by 7%. …

The Gini coefficient for wealth (at about 0.6) is close to double the Gini coefficient for income (at about 0.3) …

[A] person at the 90th percentile of the wealth distribution has almost 40 times as much wealth as [a] person at the 10th percentile; for income, they have 4 times as much. …

[There] is less wealth mobility than income mobility, and more ‘stickiness’ at the top and bottom of the wealth distribution. …

If a father’s lifetime earnings are 10% above average for his generation, we would expect his son’s lifetime earnings to be 2–4% above average for his generation.

[Intergenerational earnings elasticity: 0.22 to 0.41]

peaceandlonglife:(Rising inequality? A stocktake of the evidence, August 2018)

An intergenerational earnings elasticity of 0.3 with a paternal income ratio of 8:1, confers an 87% income advantage to the sons of the richest 10% over the sons of the poorest 10%.

(M Corak, Income inequality, equality of opportunity, and intergenerational mobility,

Journal of Economic Perspectives, 27:3, pp 79–102, 2013)

July 4, 2016

Mark Blyth

Green Army: Persons of Interest

— Mark Blyth (1967)

- Democracy is Asset Insurance for the Rich

- Redistribution and Debt is Reinsurance for Democracy

- Austerity is Anorexia for the Economy

The day of democracy is past …

Today is the day of wealth.

Wealth now is power as it never was power before —

it commands earth and sea and sky.

All power is for those who can handle wealth.

— Herbert Wells (1866 – 1946), When the Sleeper Wakes, Chapter 19, The Graphic, 1898-9.

It is difficult to get a man to understand something, when his salary depends upon his not understanding it!

— Upton Sinclair (1878 – 68), I, Candidate for Governor: And How I Got Licked, 1935.

The easiest thing in the world is self-deceit; for every man believes what he wishes, though the reality is often different.

— Demosthenes (384 – 22 BCE), Third Olynthiac, Section 19, 349 BCE.

Subscribe to:

Posts (Atom)